Insight Over Impulse

Mastering Mindset, Strategy, and Edge

Presented by Matae, Spacemonkey, JMoney & John

Hosted May 1, 2025 • 7:00 PM EST

Workshop Agenda

- Know the difference between great, good, and low-quality trades

- Spot your own setups without copying anyone else

- Understand what "edge" actually means

- Review your trades with purpose

- Member Q&A

Know the difference between great, good, and low-quality trades

So you can stop gambling and start trading with intention.

Why is it important to be able to grade trades?

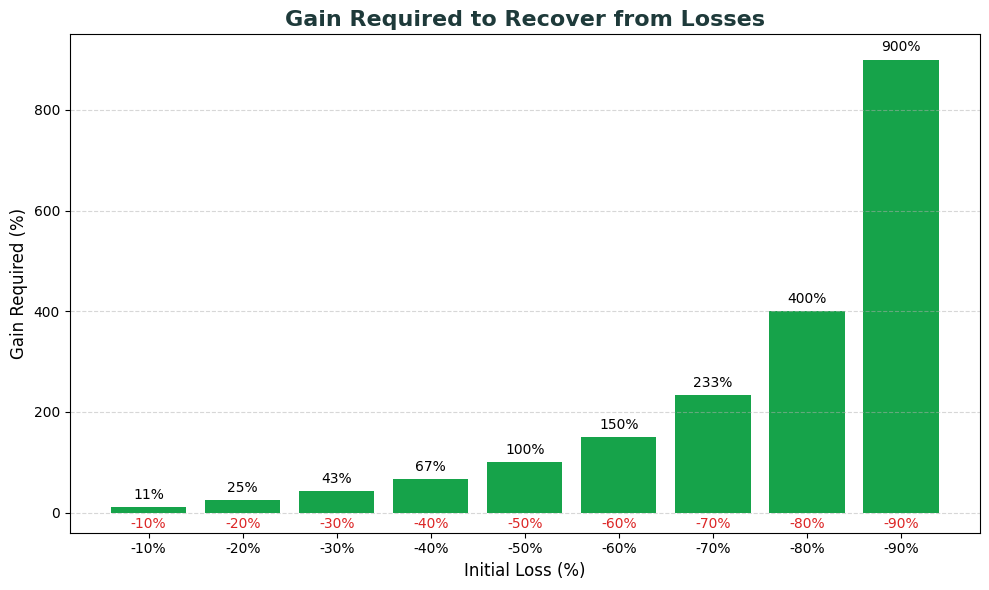

"It's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong."

- George Soros

The market has an unforgiving nature

Most of the money is made on the fewest number of opportunities

90% of gains come from 5% of days

Pushing when the odds are with you makes you as a trader

This is the cost of trading and what we are working toward everyday

Bet Sizing & Profitability

- Proper bet sizing is critical to long-term profitability

- Sizing up on high-probability trades maximizes returns

- Minimizing risk on low-probability trades preserves capital

- Your edge compounds over time with proper risk management

Before grading a trade, you need to have a defined playbook

- Concept begins with an idea by asking yourself, "what worked?"

- Setup includes a defined entry and exit strategy

- Live reps build data - not all data is equal (variance)

- If the trade has positive expectancy you can begin sizing up

- Sizing up comes from differentiating the variables

Example: Opening Drive Trade

Opening drive trade is when a stock has a catalyst, strong pre-market structure, and you take the immediate move higher or lower right at the open with momentum sell rules.

Key Components

- Catalyst present

- Strong pre-market structure

- Elevated RVOL

- RSI Divergence

- Defined exit strategy

How to grade a trade

A trade's grade is determined by the variables present in a setup that you already know has positive expectancy

Examples of trade variables:

We go through the variables of each setup before we take them in our pre-market call at 9am everyday

EX Trade Comparison: UNH vs TSLA Opening Drives

UNH - High Quality

- Quality catalyst

- Big weekly breakdown

- HTF / LTF confluence

- Significantly elevated RVOL

- Bearish RSI

TSLA - Low Quality

- Weak catalyst

- HTF choppy range

- Low RVOL

- Neutral RSI

- Poor risk/reward

Spot your own setups without copying anyone else

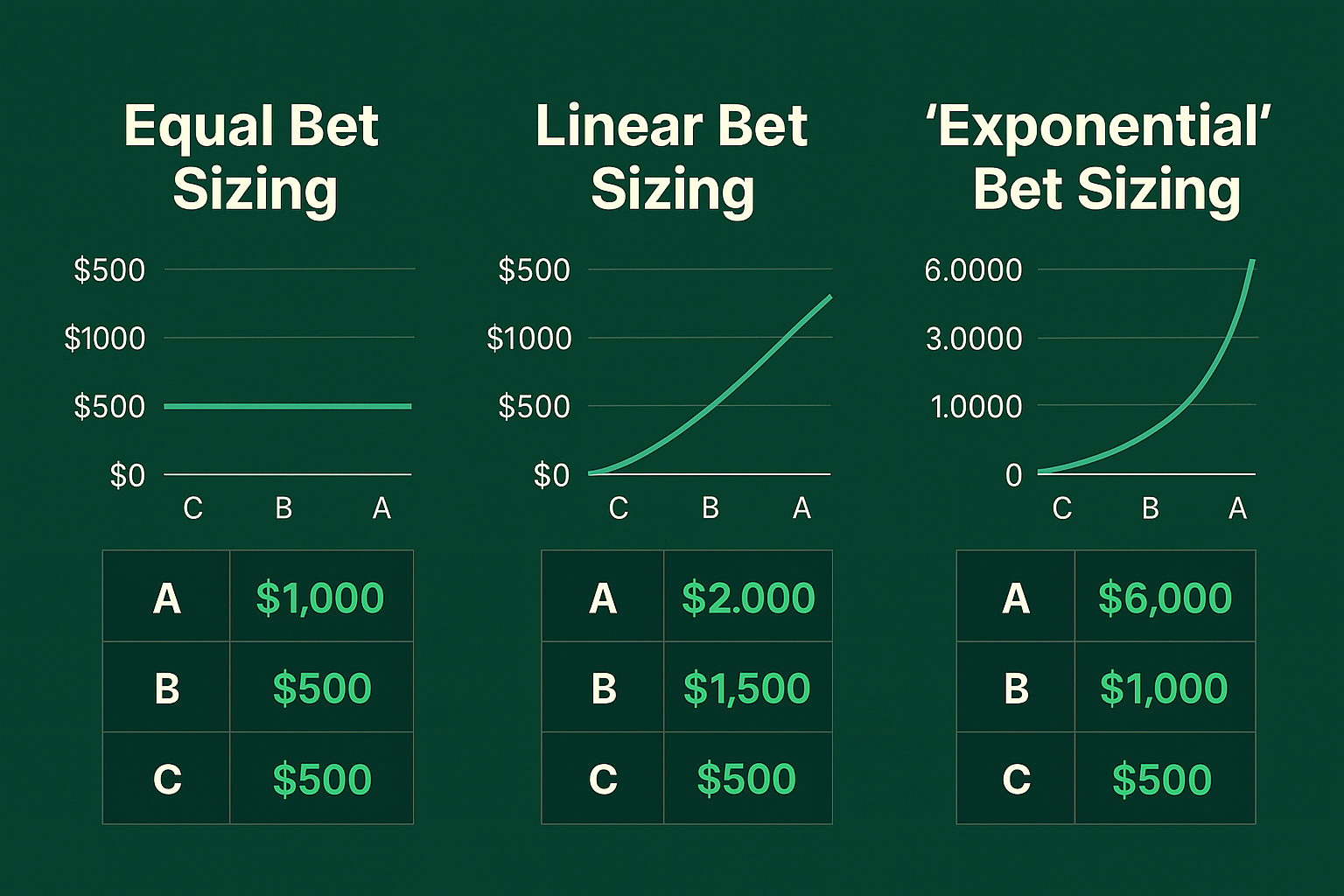

Because real skill leads to real consistency. The more you refine your edge, the more profit potential you unlock.

Joining a Trading Community

The WRONG Approach

There are major benefits to being part of a community but most people join for the wrong reasons...

They want to directly copy buy and sell alerts with the hopes of making easy money.

The RIGHT Approach

This copy-trading approach is flawed and may work at times for linear growth, but to unlock exponential growth you have to be able to size up on the unique and rare opportunities the market presents.

Benefits of a trading community

Information Edge

- Save time finding setups

- Real-time insights

- Playbook exploration

Access to Experienced Pros

- Ask questions

- Get immediate insights

- Learn from experience

Diverse Perspectives

- Different market views

- Find strategies that align with your style

- Broader market coverage

Speed Up Learning

- Access our playbooks

- Learn professional processes

- Structured approach to trading

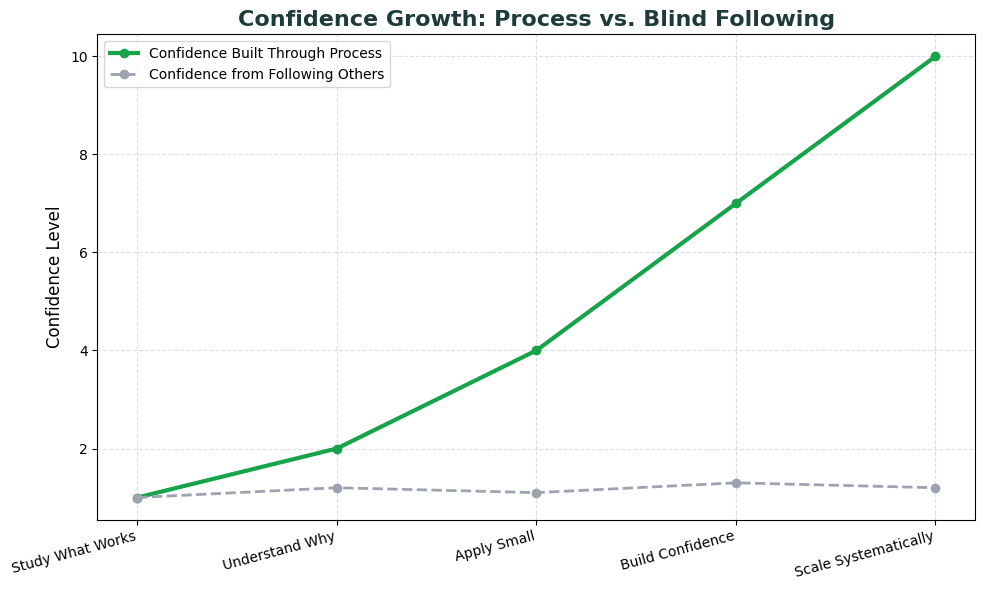

Confidence is a key requirement to sizing up

You will never build enough confidence to consistently size up just by following another trader alone.

You must understand the dynamics of the setups that are presented and their expectations. This will allow you to confidently follow your sell rules and entries.

Reverse Engineer Success

- Study what works

- Understand why it works

- Apply with small size first

- Build confidence through results

- Scale up systematically

How to Get Started in 2 Simple Steps

Study Experienced Traders

Analyze successful trades from experienced traders like us

- Ask what specific setups they use

- Understand why they took each trade

- Learn how they manage risk and exits

Daily Market Review

Ask yourself: "What worked well today?

What was the easy money trade?"

This simple but incredibly powerful thought exercise helps you identify patterns and develop your unique edge

What You'll Achieve:

Start conceptualizing what setups truly are

Become more consistent at spotting opportunities

Execute with appropriate risk management

Identify which setups work in different market regimes

Expand your playbook faster

Understand what "edge" actually means

This is our secret sauce. It's the key difference between inconsistent traders and the ones who scale with confidence.

The basic fundamentals of edge

Edge

Your statistical advantage

Psychology

Mental framework for execution

Risk Management

Position sizing & capital preservation

Successful trading requires all three components working together

Markets are designed to be efficient

Why market efficiency matters to you as a trader:

Stocks naturally trade within equilibrium ranges until catalysts create imbalances

You are competing with instituions, HFTs, Algos, and Big players (THE HOUSE)

Trying to force trades when conditions aren't right is the fastest way to lose capital

The Reality of Market Opportunities

Analysis of 251 trading days per year:

Days

Key Insight: Professional traders wait for optimal conditions and size up appropriately when rare opportunities present themselves. The other days (31%) are untradeable. Forcing trades during these periods leads to frustration, inconsistency, giving back hard-earned profits, or worse, blowing of your account.

Your Edge: Patience + Preparation + Proper Sizing

Focus your energy on identifying which type of day you're in, and adjust your strategy accordingly

Finding edge in efficiency & inefficiencies

Efficiency Edge

- Improving stock selection

- Riding momentum

- More common

- Easier to identify

- Works in most market conditions

Inefficiency Edge

- Advanced strategies

- More rare opportunities

- Don't last long

- Requires deeper knowledge

- Often higher reward when found

How to gain a statistical edge

Immediately improve your stock selection with RVOL + ATR

Relative Volume (RVOL)

- Measures current volume vs. average

- Higher RVOL = stronger interest

- Indicates potential for stronger moves

- Look for RVOL > 1.5

- Elite setups often have RVOL > 3

Average True Range (ATR)

- Measures volatility

- Higher ATR = larger price swings

- Helps set proper stop losses

- Assists in determining position size

- Great for identifying potential range

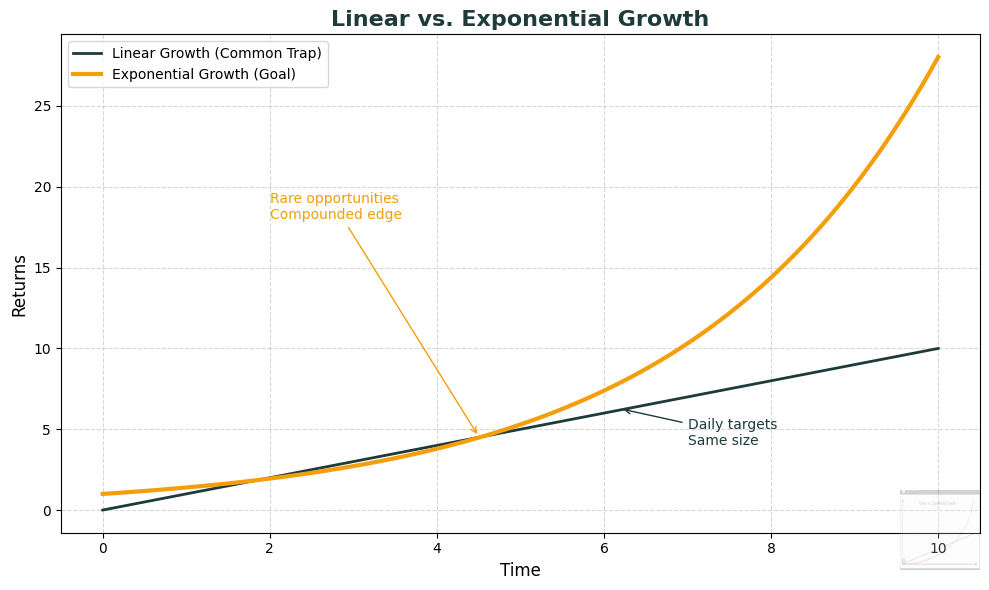

Linear vs. Exponential Growth

All the work we are putting in daily is to hit the big opportunities... not the fallacy most traders on social media push like a daily profit goal.

Linear Growth (Common Trap)

- Daily profit targets

- Same position size always

- Not accounting for fat tail risk

- Eventually levels out or fails

Exponential Growth (Goal)

- Size up on rare opportunities

- Daily work to identify key setups

- Proper risk management

- Compound returns over time

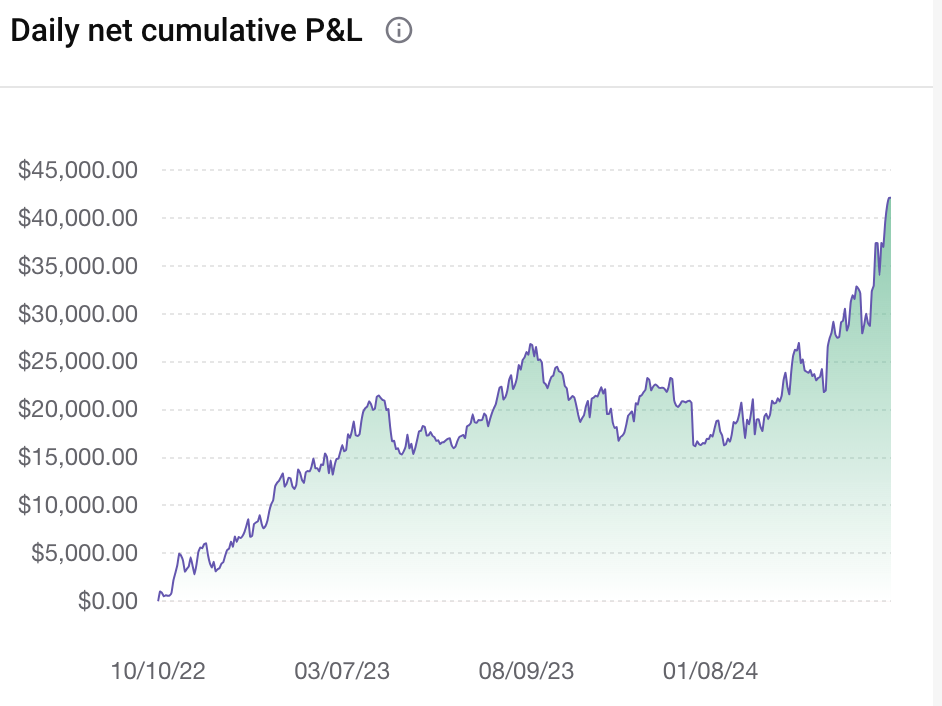

Theoretical Model

Actual Results

Review your trades with purpose

Intentional reflection is the fastest way to level up your skills and confidence

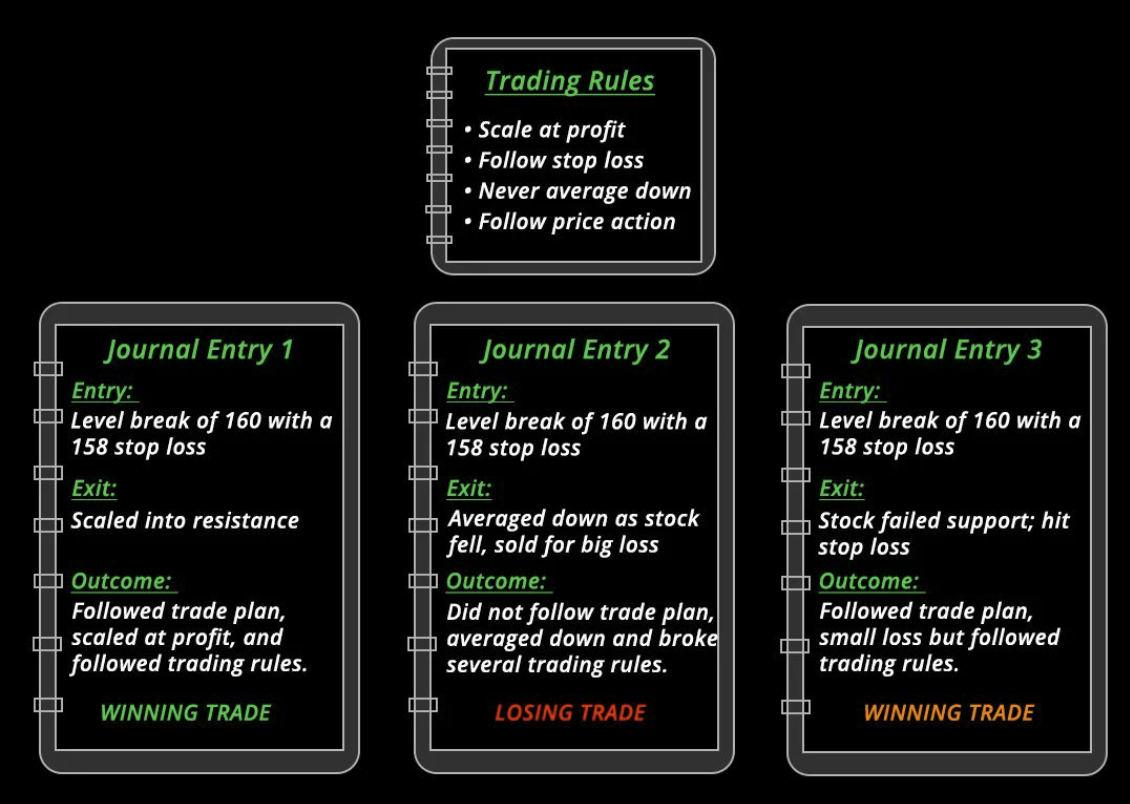

The Power of Journaling your Trades

Reviewing your trades starts with a journal. I use Notion and our Discord room to review each trade I take.

What to document:

- 📊 Variables present in the setup

- 🎯 Your entries and exits

- ✅ Did you follow your plan?

- ⚠️ Mistakes made

- 😌 Emotional state during the trade

A losing trade can be considered a win if you followed your plan and gained knowledge.

A winning trade can be considered a loss if you broke your rules and reinforced bad habits.

Benefits: Accountability, pattern recognition, and faster skill development

Consistently tracking your trades helps you identify strengths, weaknesses, and patterns in your trading performance. Journaling is a proven method to accelerate your growth and gain a real statistical edge.

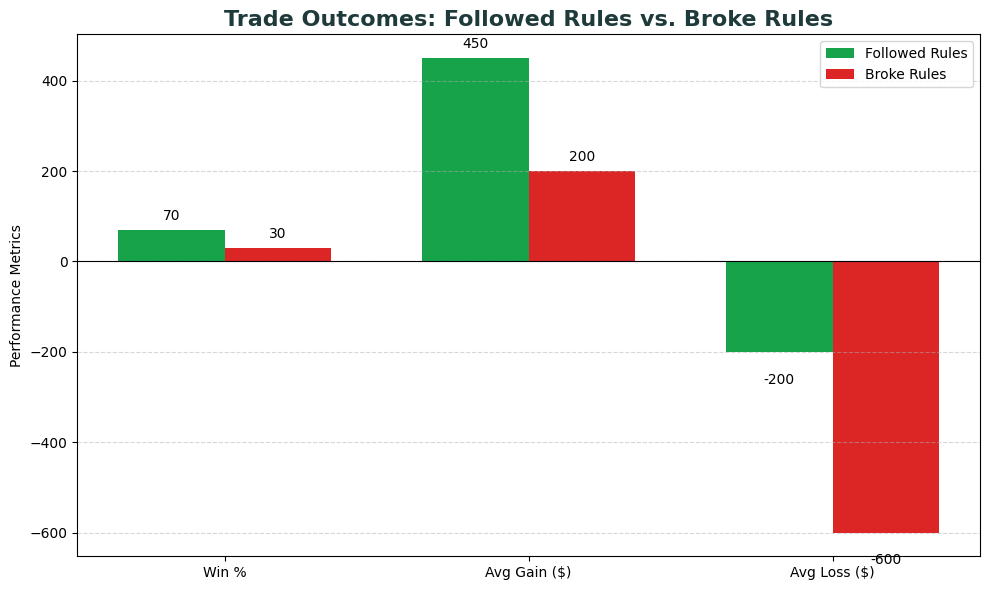

Reviewing your Trades and Data

Doing this daily will generate reports that help you see where performance is excelling or lacking

Trade Outcomes

Trading Journal

Become the Analyst of Your Trading Business

- Identify patterns in wins and losses

- Pinpoint your strengths and weaknesses

- Recognize emotional triggers

- Track improvement over time

- Make data-driven decisions

PDR = Positive Decision Rate

The percentage of times you followed your trading plan and rules correctly

If you aren't following your plan, you are introducing variability to your data

- Aim to take every trade setup consistently and follow your rules

- Perfection isn't the goal, but consistency in actions is critical

- Better data breeds more confidence

- Higher PDR takes you one step closer to sizing up

Technical Trading Strategies

Practical techniques used by the TWI Team

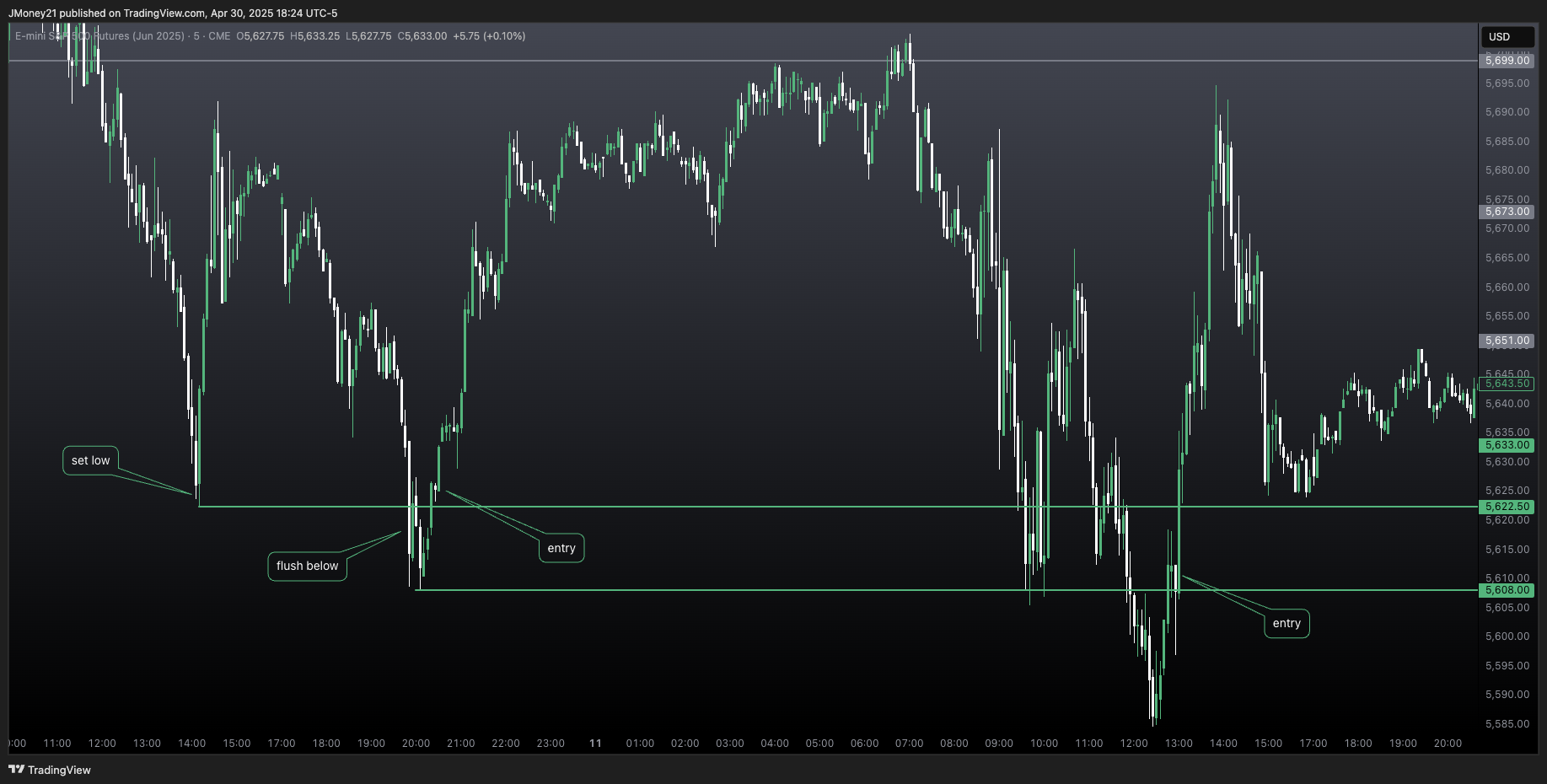

Failed Breakdown

Key Characteristics

- Price breaks below a prior low

- Quickly reverses and reclaims the level

- Often accompanied by high volume on the reversal

- Previous support now becomes resistance

- Strong indicator of trend reversal

Failed breakdowns often lead to powerful moves in the opposite direction

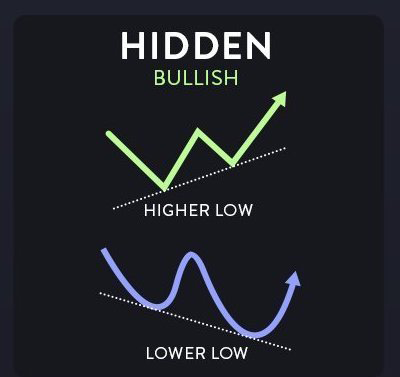

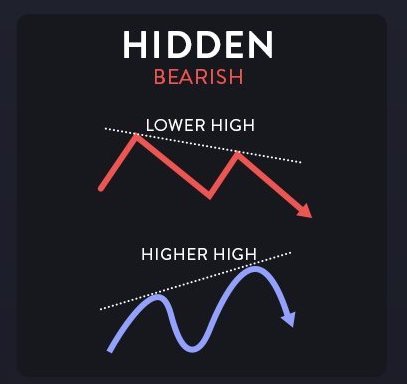

RSI Hidden Divergence

Hidden divergence occurs when RSI makes a new high/low but price does not confirm with its own new high/low.

Bullish Hidden Divergence

- Price makes a higher low

- RSI makes a lower low

- Indicates energy available for upside

- Signals potential upward continuation

- Confirms strength in existing uptrend

Bearish Hidden Divergence

- Price makes a lower high

- RSI makes a higher high

- Indicates potential downward reversal

- Confirms weakness in current price action

- Often signals continuation of downtrend

Earnings Reversals

How I Trade It

Earnings gap downs can become strong reversal opportunities. If a stock gaps down between 1% - 5% and buyers step in fast, closing near the highs, it can fuel a multi-day move as shorts cover and momentum builds.

Things To Look For

- 1% - 5% gap down

- Aggressive buyers stepping in

- Red to green move (preferred)

- A close near the highs

- Watch for continuation day after

Example: ASTS Earnings Reversal

Member Q&A

Let's answer your questions!

Ready to Trade With Insight?

Special pricing available for ONLY 72 HOURS after this webinar!

6-Month Pro

- ALL Trade Alerts (Entries & Exits)

- Daily Live Streams (Video/Audio)

- Access to Head Traders & Analysts

- Daily Market Recap Analysis

- Trading Bots (Gamma, Levels)

- Private 24-Hour Trading Community

Contact: john@tradewithinsight.com